Unlocking NYC Property Tax Savings: The Prevailing Wage Tax Abatement Advantage

As a seasoned NYC real estate broker, I often guide clients through the intricate landscape of property ownership in our vibrant city. One of the most impactful yet underutilized incentives is the Cooperative and Condominium Property Tax Abatement, especially when paired with compliance to prevailing wage requirements. Let's delve into how this synergy can lead to significant financial benefits for co-op and condo owners.

Understanding the Cooperative and Condominium Property Tax Abatement

Introduced in 1996, this abatement aims to level the property tax playing field between apartment owners and those owning one- to three-family homes, which are taxed at lower rates. Eligible co-op and condo owners can receive a property tax reduction ranging from 17.5% to 28.1%, depending on the unit's assessed value. For instance, a 1,000-square-foot condo in Chelsea with an assessed value of $121,000 qualifies for a 17.5% reduction.

The Role of Prevailing Wage Compliance

Starting July 1, 2022, a crucial amendment mandates that certain buildings pay their service employees the prevailing wage to qualify for the tax abatement. Specifically, this applies to:

Buildings with 30 or more residential units and an average assessed unit value over $60,000.

Buildings with fewer than 30 units and an average assessed unit value over $100,000.

The prevailing wage is determined annually by the New York City Comptroller and reflects the wage and benefit rates of collective bargaining agreements, notably those between SEIU Local 32BJ and the Realty Advisory Board on Labor Relations.

Benefits of Compliance

Financial Savings: By adhering to prevailing wage standards, buildings remain eligible for substantial tax abatements, translating to significant savings for unit owners.

Enhanced Staff Retention: Fair compensation fosters employee satisfaction, reducing turnover and ensuring consistent building maintenance and services.

Market Appeal: Buildings that maintain compliance and offer tax savings are more attractive to potential buyers, enhancing property values.

Compliance Requirements

To benefit from the abatement:

Submit a notarized prevailing wage affidavit by February 15 each year, confirming that building service workers are paid the prevailing wage.

Ensure that the building does not receive other conflicting tax benefits, such as those under the Urban Development Action Area Program or the Mitchell-Lama program.

Conclusion

Navigating NYC's real estate landscape requires a keen understanding of available incentives and compliance mandates. By aligning with prevailing wage requirements, co-op and condo owners not only unlock significant tax savings but also contribute to fair labor practices, enhancing the overall value and appeal of their properties.

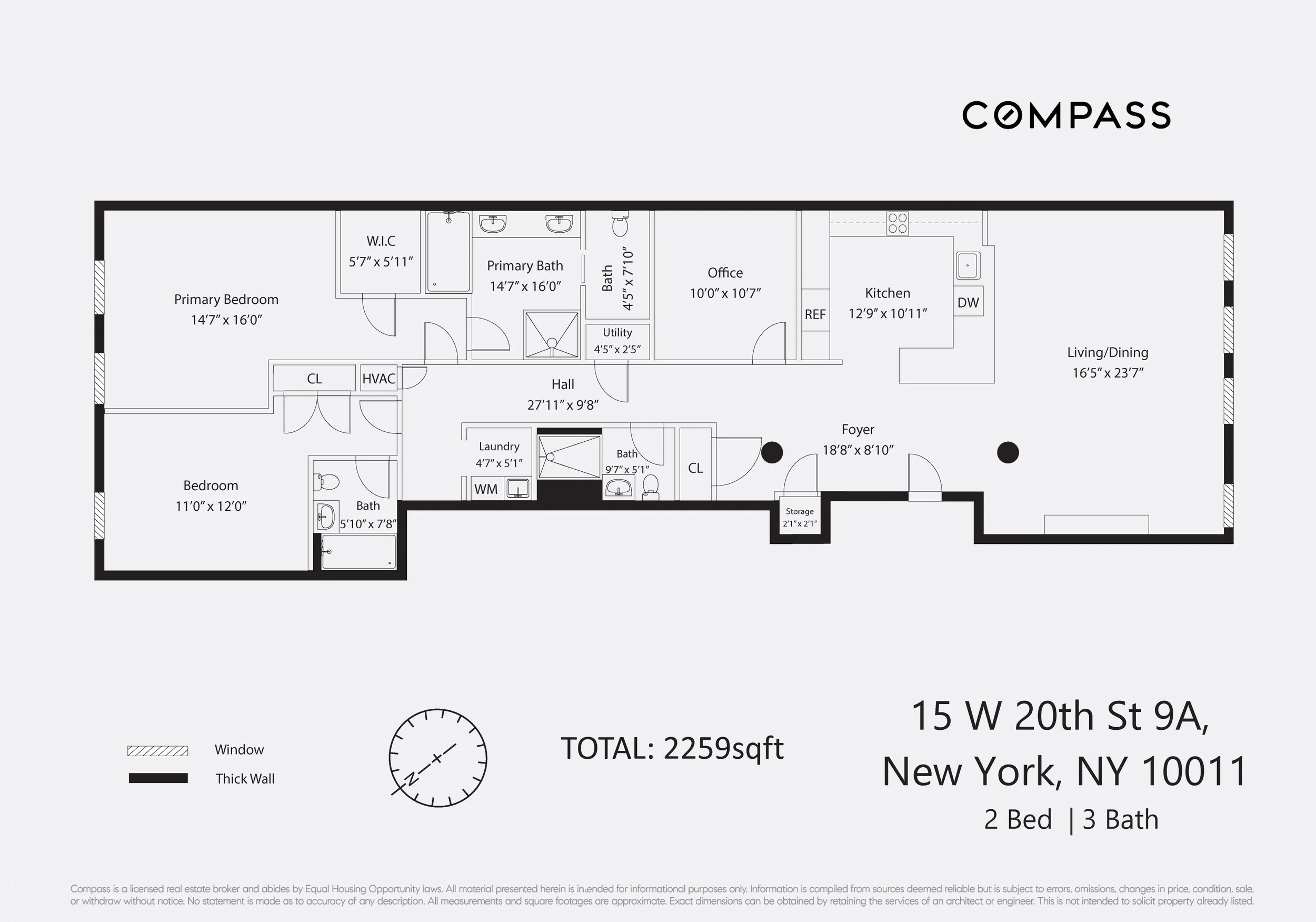

My current listing at 15 West 20th Street, The Altair 20 Condo by Extell, recently applied for this tax abatement. The individual unit owner of 9A will benefit from a $10,000 annual tax abatement starting 2026. See listing here.

Sources:

https://www.joindaisy.com/blog/nyc-co-op-condo-tax-abatement-and-prevailing-wage-affidavit

https://www.fsresidential.com/new-york/news-events/articles-and-news/faq-the-impacts-of-new-york-city%E2%80%99s-prevailing-wage/